Fund Info Archive

2025 Fund Information

New Employer Health Care Rates Approved by Trustees

The Board of Trustees of the Automotive Industries Welfare Plan have approved the employer health care rates at their June meeting. Health care costs continue to rise throughout the country and our plan is not immune to being impacted by this upward trend in costs. The Trustees reviewed the actuarial information provided by the consultant very carefully and the rates were increased as minimally as possible for the employees and the employers equally.

Effective September 1, 2025, the health care rates will increase between 7% – 9% across all contracts between the employers and the union. If you are under the Plan A benefit plan or have family coverage under Plan B, Plan C or Plan K, your employer will see an increase in the monthly premium by approximately $200. If you have single coverage under the medical plans, your employer will see an increase in the monthly premium by approximately $70. If you are married without children under the medical plans, the employer will see an increase in the monthly premium by approximately $125.

Please check your collective bargaining agreement to see what the cost share of the health care premium is that you will be responsible for as of September 1, 2025.

Pension Plan Special Financial Assistance – 2 Year Update

It has been almost two years since the Pension Plan received the Special Financial Assistance (SFA) as part of the American Rescue Plan Act. The $1.1 billion we received is solely be used to pay benefits and expenses, thus allowing the “legacy” assets to grow. This single action helped secure the financial stability of the pension payments for each and every participant.

Since we received the money in August 2023, we have been able to:

- Grow the Legacy Portfolio by approximately $185 Million.

- Expand the asset allocation of the Legacy Portfolio to include more long-term investment options to maximize returns.

- Earn 6.41% return on the SFA Bond Portfolio.

Thanks to the SFA program, the Pension Plan is now secure to continue on to provide benefit payments for all participants through the year 2053.

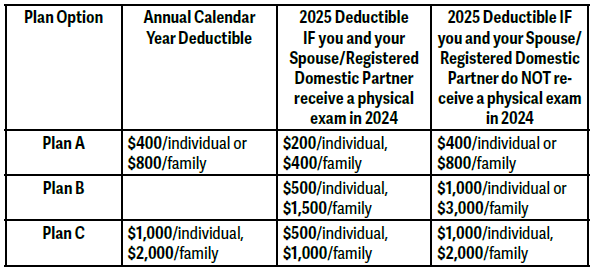

Annual Physical Required to Lower Deductible in 2026 Under Blue Cross Self-Funded Plan Options

In 2023, the Board of Trustees instituted an annual physical exam requirement for those on the self-funded medical plans offered by the Automotive Industries Welfare Plan so that members may receive a lower calendar-year deductible. The deductible amounts are now in place for the 2025 calendar year, but participants and their spouse or domestic partner (if applicable) who get an annual physical exam anytime in 2025 will be moved to the lower deductible level in the 2026 calendar year, along with all dependent children.

The physical exam can be taken any time before the end of the 2025 Calendar Year (December 31) and requires the Plan’s certification form to be sent to the Trust Fund Office.

|

Plan Option |

Annual Calendar Year Deductible |

2026 Deductible IF you and your Spouse/Registered Domestic Partner receive a physical exam in 2025 |

2026 Deductible IF you and your Spouse/Registered Domestic Partner do NOT receive a physical exam in 2025 |

|

Plan A |

$400/individual or $800/family |

$200/individual or $400/family |

$400/individual or $800/ family |

|

Plan B |

1,000/individual or $3,000/family |

$500/individual or $1,500/family |

$1,000/individual or $3,000/ family |

|

Plan C |

$1,000/individual or $2,000/family |

$500/individual or $1,000/family |

$1,000/individual or $2,000/ family |

Physical Exam certification forms are available to download at the Trust Fund website at www.aitrustfunds.org. A separate form must be submitted for you and your spouse or domestic partner (if applicable) to reduce your deductible for the 2026 calendar year.

If you have questions about what current deductible level you are in, please contact the Trust Fund Office at 800-635-3105 or by email at AISupport@hsba.com.

Value Based Program

There are wide treatment cost variations for elective outpatient procedures and other types of surgeries. The Value-Based Pricing Program was implemented on January 1, 2015, to keep out-ofpocket costs down to a minimum.

Under the Value-Based Program, the following elective surgeries have a dollar cap limitation when performed in a hospital rather than an Ambulatory Surgical Center (ASC).

- Colonoscopy = $1,500

- Arthroscopy = $6,000

- Cataract Surgery = $2,000

(The above pricing only pertains to surgeries performed in a hospital setting regardless of the hospital being in-network or out-of-network).

Hip and Knee Replacement surgeries will be limited to a maximum payment of $30,000 for a single hip joint replacement or a single knee joint replacement. The maximum includes all inpatient facility costs; professional fees (surgeon or anesthesia) are paid under a separate benefit.

If you are going to have any of the above procedures performed in the near future, please contact the Trust Fund Office for a list of the Value-Based Facilities or you can look up the facilities directly at www.anthem.com

Reminder: Pension plan seeking former participants

The Automotive Industries Pension Plan currently has approximately 2,000 participants who are entitled to receive a pension payment under the Plan but have not made application for their money. If you know someone who used to work in the industry during the 1970’s

or 1980’s, is over age 65, and is not receiving a pension payment from the Trust Fund, they could be missing out a monthly payment from the Plan. Have them contact the Trust Fund Office at 800-635-3105 for a review of their work history to see if they are eligible.

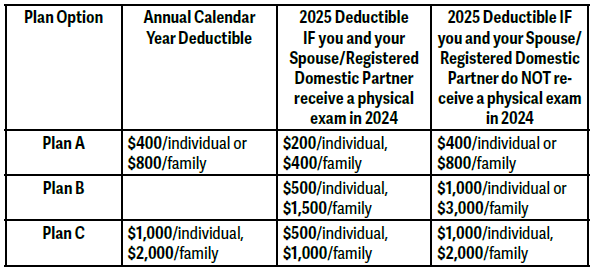

Annual physical required to lower deductible in 2025 under Blue Cross Self-Funded Plan options

In 2023, the Board of Trustees instituted an annual physical exam requirement for those on the self-funded medical plans offered by the Automotive Industries Welfare Plan in order to receive a lower calendar-year deductible.

The deductible amounts are now in place for the 2024 calendar year but participants and their spouse or domestic partner (if applicable), who get an annual physical exam anytime in 2024 will be moved to the lower deductible level in the 2025 calendar year along with all dependent children.

The physical exam can be taken any time before December 31, 2024 and requires the Plan’s certification form to be sent to the Trust Fund Office. Physical Exam certification forms are available to download at the Trust Fund website at www.aitrustfunds.org. A separate form must be submitted for you and your spouse or domestic partner (if applicable) to reduce your deductible for the 2025 calendar year.

If you have questions about what current deductible level you are in, please contact the Trust Fund Office at 800-635-3105 or by email at AISupport@hsba.com.

On disability? Submit your claim form on time with all required information

Contracts that have negotiated the Short Term Disability benefit available through the Welfare Plan will provide up to 80% of your hourly wage when combined with your State Disability or Workers’ Compensation payments.

If you need to file a claim with the Trust Fund Office, make sure you have provided all the required information with your claim form. Missing or incomplete information will cause a delay in your receiving weekly payments from the Plan. Any and all questions can be answered by contacting the Trust Fund Office at (800) 635-3105 before you submit your claim. You can also submit questions by email to AISupport@hsba.com.

Your Rights and Protections Against Surprise Medical Bills

Effective January 1, 2022, the No Surprises Act went into effect. This law prohibits medical providers from “balance billing” you when you get emergency care or get treated by an-out of-network provider at an in-network hospital or ambulatory surgical center.

“Surprise billing” is an unexpected balance bill. This can happen when you can’t control who is involved in your care—like when you have an emergency or when you schedule a visit at an in-network facility but are unexpectedly treated by an out-of-network provider.

You are protected from balance billing for:

• Emergency services: If you have an emergency medical condition and get emergency services from an out-of-network provider or facility, the most the provider or facility may bill you is your plan’s in-network cost-sharing amount (such as co-payments and co-insurance). You can’t be balance billed for these emergency services. This includes services you may get after you’re in stable condition unless you give written consent and give up your protections not to be balanced billed for these post-stabilization services.

• Certain services at an in-network hospital or ambulatory surgical center: When you get services from an in-network hospital or ambulatory surgical center, certain providers there may be out-of-network. In these cases, the most those providers may bill you is your plan’s in-network cost-sharing amount. This applies to emergency medicine, anesthesia, pathology, radiology, laboratory, neonatology, assistant surgeon, hospitalist, or intensivist services. These providers can’t balance bill you and may not ask you to give up your protections not to be balance billed.

You’re never required to give up your protections from balance billing. You also aren’t required to get care out-of-network. You can choose a provider or facility in your plan’s network. If you believe you’ve been wrongly billed, you may contact the Automotive Industries Welfare Plan at 800-635-3105, by email at AISupport@hsba.com, or by visiting www.aitrustfunds.org for assistance. Visit www.cms.gov/nosurprises for more information about your rights under federal law.

Pension plan searching for former participants

Currently, approximately 2,000 current or former union members who are entitled to receive pension payments under the Automotive Industries Pension Plan have not applied for their money. If you know someone who used to work in the industry during the 1970s or 1980s, is over age 65, and is not receiving a pension payment from the Trust Fund, they could be missing out on monthly payments from the Plan. Have them contact the Trust Fund Office at 800-635-3105 for a review of their work history to see if they are eligible.

Pension Plan 2024 year-end tax documents

The Trust Fund Office has mailed the Pension Plan 2024 1099-R Tax Forms to all retirees receiving monthly pension payments. Please review this document carefully and contact the Trust Fund Office at AISupport@hsba.com or by phone at 800-635-3105 if you believe an error has been made on the form.

After January 31, 2025, the 1099-R Tax Formswill also be available on the Trust Fund website at www.aitrustfunds.org and can be downloaded or printed directly from the website. If you don’t already have access to the website, creating an online account is simple and takes minutes to complete. Visit www.aitrustfunds.org for details on how to create an account so that you can review your benefit information.

Your Rights and Protections Against Surprise Medical Bills

Effective January 1, 2022, the No Surprises Act went into effect; this law constrains medical providers from what’s called “balance-billing,” which may happen when you get emergency care or get treated by an out-of-network provider at an in-network hospital or ambulatory surgical center. You are protected from balance billing for:

Emergency services: If you have an emergency medical condition and get emergency services from an out-of-network provider or facility, the most the provider or facility may bill you is your plan’s in-network cost-sharing amount, such as copayments and coinsurance. You cannot be balance-billed for these emergency services. This includes services you may get after you’re in stable condition unless you give written consent and give up your protections not to be balanced-billed for these post-stabilization services.

Certain services at an in-network hospital or ambulatory surgical center: When you get services from an in-network hospital or ambulatory surgical center, certain providers there maybe out-of-network. In these cases, the most those providers may bill you for is your plan’s in-network cost-sharing amount. This applies to emergency medicine, anesthesia, pathology, radiology, laboratory, neonatology, assistant surgeon, hospitalist, or intensivist services. These providers can’t balance-bill you and may not ask you to give up your protection not to be balance-billed.

You are never required to give up your protections from balance-billing. You also aren’t required to get care out-of-network. You can choose a provider or facility in your plan’s network.

If you believe you’ve been wrongly billed, you may contact the Automotive Industries Welfare Plan at 800-635-3105, by email at AISupport@hsba.com, or by visiting www.aitrustfunds.org for assistance. Visit https://www.cms.gov/nosurprises for more information about your rights under federal law.

The Member Assistance Program can help with many life-related stresses

The Trustees of the Automotive Industries Welfare Fund partnered with Uprise Health to provide an Employee Assistance Program (EAP)

and a Legal/Financial Program (LFP). These resources can help you resolve personal problems in the early stages.

Uprise Health offers a confidential support service and referral program. It is designed to help you and your family with personal issues

such as:

| • Stress • Parenting • Aging • Grief/Loss • Anxiety • Relationships • Adoption • Estate planning • Bankruptcy • Immigration • Child custody |

• Real estate • Family • Marriage • Work issues • Alcohol/Drug issues • Finances • Depression • Criminal issues • Tenant’s rights • Divorce |

Customer Care Professionals will help you find the right resources and services including counselors, legal representatives, and financial professionals who can provide counseling sessions, coordinate the appropriate treatment, and provide referrals if needed. Office hours are 6am to 5pm PST. After hours calls will be returned the following day. Crisis support is available 24 hours a day, 7 days a week.

The services provided under the EAP and LFP program are 100% confidential and are at no cost to your or your dependents. For more information or to get assistance in making an appointment, call Uprise Health at 1-888-690-1349 or visiting https://hmc.personaladvantage.com using AUTOMOTIVE as the access code.

Reminder: Pension Plan Searching for Former Participants

The Automotive Industries Pension Plan currently has about 2,000 participants who are entitled to receive a pension payment under the

plan but have not made an application for their money. If you know someone who used to work in the industry during the 1970s or 1980s, is over age 65, and is not receiving a pension payment from the Trust Fund, they could be missing out on a monthly payment from the plan. Have them contact the Trust Fund Office at 800-635-3105 for a review of their work history to see if they are eligible.

2024 Annual Funding Notice Mailing

The Trust Fund Office recently mailed out the Automotive Industries Pension Plan’s Annual Funding Notice (AFN) for the 2024 Plan Year. This notice provides information on the Plan’s funding levels and other information about the Pension Plan. The mailing is required by law and is sent on or around the last week of April to all active, retired and terminated vested participants in the Pension Plan. The AFN will show that the Plan is listed as being 42.7% funded for the 2024 Plan Year.

That 42.7% reported on the AFN does not include the $1 Billion in assets received by the Plan under the Special Financial Assistance (SFA) program. It is just based on the “legacy” assets held by the Plan. Rest assured that the Plan has sufficient funding that will allow it to remain solvent and pay benefits to all plan participants through 2053 or longer.

As advised last year, the American Rescue Plan Act of 2021 (ARPA) was signed into law on March 11, 2021. Among other things, ARPA provided various forms of funding relief for multi-employer pension plans. Most notably, ARPA established a new program under which the Pension Benefit Guarantee Corporation (PBGC) provided severely distressed multiemployer plans with SFA in order to keep them solvent. The Board of Trustees had filed for SFA in 2023 and the Pension Fund received $1,081,455,840 on August 21, 2023, from the PBGC.

If you want to learn more about the SFA program and how it was applied to the Automotive Industries Pension Plan, please visit the PBGC website at www.pbgc.gov/arp-sfa.

Why the Trust Fund is Mailing HRA Debit Card Confirmation Letters

If you utilize an HRA Debit Card with your medical benefits, you have probably received a letter from the Trust Fund office asking for additional information on services that were charged to the card. The question most asked about these letters is, “Do I really have to send the information requested into the Fund Office?

Yes. You do. The letter is known as a “substantiation letter” and it is being sent by the Trust Fund Office because the IRS requires the Welfare Plan to verify that all charges and purchases made using the HRA card were for an eligible medical expense (as defined by the IRS). Substantiation letters are not generated for all card transactions. They are usually generated when the amount that is paid through the card does not match the plan information. Information that is being confirmed is:

- Service Date or Purchase Date

- Description of Service/Item Purchase

- Name of Provider/Merchant

- Claim Amount

As a participant in the Plan, you are required to complete the substantiation letter and provide documents that will confirm the information required by the IRA. In most cases, the Explanation of Benefits (EOB) from the medical provider or HMO will be sufficient information to fulfill the substantiation letter requirements. If you have any questions about the letters or what documentation needs to be provided, please call the Trust Office.

Have issues?

The Member Assistance Program can help with many life-related stresses, including relationships, work issues, grieving, bankruptcy, depression, real estate and so much more. Call the number below for confidential services and referrals.

2024 Fund Information

Annual physical required to lower deductible in 2025 under Blue Cross Self-Funded Plan options

In 2023, the Automotive Industries (AI) Board of Trustees instituted an annual physical exam requirement so that those on self-funded medical plans offered by the AI Welfare Plan can receive a lower calendar year deductible. The deductible amounts are now in place for the 2024 calendar year, but participants and their spouse or domestic partner (if applicable) who get an annual physical exam anytime in 2024 will be moved to the lower deductible level in the 2025 calendar year, along with all dependent children.

The physical exam can be taken any time before the end of the 2024 Calendar Year (December 31) and requires the Plan’s certification form be sent to the Trust Fund Office.

Physical Exam certification forms are available to download at the Trust Fund website at www.aitrustfunds.org. A separate form must be submitted for you and your spouse or domestic partner (if applicable) to reduce your deductible for the 2025 calendar year.

If you have questions about what current deductible level you are in, please contact the Trust Fund Office at 800-635-3105 or by email at AISupport@hsba.com.

Need glasses? Use Vision Service Plan (VSP)

Collective bargaining agreements that include vison benefits under the welfare plan are provided exclusively by Vision Service Plan (VSP). The plan has contracted with VSP for many years because of their extensive network of providers. The vision plan will cover the following services for members:

- Exam every 24 months

- Lenses and frames every 24 months.

- $25 Exam Copay ($60 Copay for contact lens exam)

- $130 Frame Allowance

- $130 Elective Contact Lens Allowance

You can locate a VSP provider by going to www.vsp.com. VSP also provides an online option for ordering glasses and virtual try-on tools at www.eyeconic.com

HRA debit card confirmation letters – Why are these being mailed by the Trust Fund?

If you utilize an HRA Debit Card with your medical benefits, you probably have received a letter from the Trust Fund Office asking for additional information on services that were charged to the card. The question most asked about these letters is, “Do I really have to send the information requested into the Fund Office?”

The letter is known as a “substantiation letter” and it is being sent by the Trust Fund Office because the IRS requires the Welfare Plan to verify that all charges and purchases made using the HRA card were for an eligible medical expense (as defined by the IRS). Substantiation letters are not generated for all card transactions. They are usually generated when the amount that is paid through the card does not match the plan information.

Information that is being confirmed is:

- Service Date or Purchase Date

- Description of Service/Item Purchase

- Name of Provider/Merchant

- Claim Amount

As a participant in the Plan, you are required to complete the substantiation letter and provide documents that will confirm the information required by the IRS. In most cases, the Explanation of Benefits (EOB) from the medical provider or HMO will be enough information to fulfill the substantiation letter requirements.

If you have any questions about the letters or the documentation that needs to be provided, please call the Trust Office.

Pension plan searching for former participants

Currently, approximately 2,000 current or former union members who are entitled to receive pension payments under the Automotive Industries Pension Plan have not applied for their money. If you know someone who used to work in the industry during the 1970s or 1980s, is over age 65, and is not receiving a pension payment from the Trust Fund, they could be missing out on a monthly payment from the Plan. Have them contact the Trust Fund Office at 800-635-3105 for a review of their work history to see if they are eligible.

Have issues?

The Member Assistance Program can help with many life-related stresses, including relationships, work issues, grieving, bankruptcy, depression, real estate and so much more. Call the number below for confidential services and referrals.

1-888-690-1349

https://hmc.personaladvantage.com

(Use code: AUTOMOTIVE)

Pension Plan 2023 Year End Tax Documents

The Trust Fund Office will be mailing the Pension Plan 2023 1099-R Tax Forms no later than January 31, 2024, to all retirees receiving monthly pension payments.

After January 31, 2024 the 1099-R Tax Forms will also be available on the Trust Fund website at www.aitrustfunds.org and can be downloaded or printed directly from the website. If you don’t already have access to the website, creating an online account is simple and takes just a few minutes to complete. Visit www.aitrustfunds.org for details on how to create an account so that you can review your benefit information.

Your rights and protections against surprise medical bills

Effective January 1, 2022, the No Surprises Act went into effect. This law prohibits medical providers from “balance billing” you when you get emergency care or get treated by an out-of-network provider at an in-network hospital or ambulatory surgical center. “Surprise billing” is an unexpected balance bill. This can happen when you can’t control who is involved in your care—like when you have an emergency or when you schedule a visit at an in-network facility but are unexpectedly treated by an out-ofnetwork provider.

You are protected from balance billing for:

Emergency services

If you have an emergency medical condition and get emergency services from an out-of-network provider or facility, the most the provider or facility may bill you is your plan’s in-network cost-sharing amount (such as copayments and coinsurance). You can’t be balance billed for these emergency services. This includes services you may get after you’re in stable condition unless you give written consent and give up your protections not to be balanced billed for these post-stabilization services.

Certain services at an in-network hospital or ambulatory surgical center

When you get services from an in-network hospital or ambulatory surgical center, certain providers there may be out-of-network. In these cases, the most those providers may bill you is your plan’s in-network cost-sharing amount. This applies to emergency medicine, anesthesia, pathology, radiology, laboratory, neonatology, assistant surgeon, hospitalist, or intensivist services. These providers can’t balance bill you and may not ask you to give up your protections not to be balance billed.

You’re never required to give up your protections from balance billing. You also aren’t required to get care out-of-network. You can choose a provider or facility in your plan’s network. If you believe you’ve been wrongly billed, you may contact the Automotive Industries Welfare Plan at (800) 635-3105, by email at AISupport@hsba.com, or by visiting www.aitrustfunds.org for assistance. Visit www.cms.gov/nosurprises for more information about your rights under federal law.

The Member Assistance Program can help with many life related stresses

The Trustees of the Automotive Industries Welfare Fund partnered with Uprise Health to provide an Employee Assistance Program (EAP) and a Legal/Financial Program (LFP). These resources can help you resolve personal problems in the early stages.

Uprise Health offers a confidential support service and referral program. It is designed to help you and your family with personal issues such as:

• Stress

• Parenting

• Aging

• Grief/Loss

• Anxiety

• Relationships

• Family

• Marriage

• Work Issues

• Alcohol/Drug

• Finances

• Depression

• Adoption

• Estate Planning

• Bankruptcy

• Immigration

• Child Custody

• Real Estate

• Criminal Issues

• Tenant’s Rights

• Divorce

Customer Care Professionals will help you find the right resources and services including counselors, legal representatives, and financial professionals who can provide counseling sessions, coordinate the appropriate treatment, and provide referrals if needed. Office hours are from 6 am to 5pm PST. After hours calls will be returned the following day. Crisis support is available 24 hours a day, 7 days a week.

The services provided under the EAP and LFP program are 100% confidential and are at no cost to your or your dependents. For more information or to get assistance in making an appointment, call Uprise Health at 1-888-690 1349 or visit https://hmc.personaladvantage.com using the AUTOMOTIVE as the access code.

Reminder: Pension plan searching for former participants

The Automotive Industries Pension Plan currentlyvhas approximately 2,000 participants who are entitled to receive a pension payment under the plan but have not made an application for their money. If you know someone who used to work in the industry during the 1970’s or 1980’s, is over age 65 and is not receiving a pension payment from the Trust Fund, they could be missing out on a monthly payment from the plan. Have them contact the Trust Fund Office at 800-635-3105 for a review of their work history to see if they are eligible.

2023 Fund Information

Annual Physical Required to Keep Lower Deductible in 2024 Under Blue Cross Self- Funded Plan Options

The Board of Trustees lowered the annual calendar year deductible for all Participants enrolled in a Blue Cross Self-Funded Plan Option for the 2023 calendar year. A condition of keeping the deductible at the lower level is that the participant and the participant’s dependent spouse or domestic partner obtain a routine physical exam sometime in the calendar year 2023. Depending on your Plan, your deductible will change as outlined in the chart below if you and your spouse or domestic partner do not receive routine physical exams. If you and your spouse haven’t completed a wellness exam, you must do so by December 31, 2023. A separate form must be submitted for you and your spouse or domestic partner (if applicable) to reduce your deductible for the calendar year 2024. You can download the certification form by visiting www.aitrustfunds.org

Special Financial Assistance FAQs are now available

Now that the Automotive Industries Pension Plan has received over $1 Billion in Special Financial Assistance (SFA) through the American Rescue Plan Act, there are many questions that you may have about the money received and what it will mean for the Plan. At the direction of the Trustees, a set of Asked Questions (FAQs) has been published and is now available online. The list of FAQs will not answer every question about the SFA funding received, but they will explain the basics of the SFA program, why the Plan received the money, and how it will affect all members who have a benefit with the Pension Plan. The FAQs are available at www.aitrustfunds.org.

On Disability? Submit Your Claim Form On Time and With All Required Information

Contracts that have negotiated the Short Term Disability benefit available through the Welfare Plan will provide up to 80% of your hourly wage when combined with your state disability or workers’ compensation payments. If you need to file a claim with the Trust Fund Office, make sure to provide all the required information with your claim form. Missing or incomplete information will cause a delay in your receiving weekly payments from the Plan. If you have questions, contact the Trust Fund Office at 8 0 0 – 6 3 5 – 3105 or by email at AISupport@ hsba.com before you submit your claim.

Pension plan searching for former participants

The Automotive Industries Pension Plan currently has approximately 2,000 participants who are entitled to receive a pension payment under the Plan but have not made an application for their money. If you know someone who used to work in the industry during the 1970s or 1980s, is over age 65, and is not receiving a pension payment from the Trust Fund, they could be missing out on a monthly payment from the Plan. Have them contact the Trust Fund Office at 800.635.3105 for a review of their work history to see if they are eligible.

Employer contribution rates for welfare benefits will receive modest increases for first time in three years

The employer contribution rates for all welfare plan benefits (medical, prescription, dental, orthodontic, vision, life insurance and short-term disability) are reviewed annually by the Trustees. Due to the unfavorable claims experience of both the self-funded Blue Cross and Kaiser HMO options over the past year, the Trustees made the decision to increase the welfare rates charged to employers starting September 1, 2023.

The rates for the medical plan were increased approximately 5% across all plan options (Plan A, Plan B, Plan C, and Plan K). However, in order to keep the overall costs down for the employer and participants, the ancillary benefits such as dental, vision, orthodontia, life insurance, and short-term disability saw little to no increase from the prior year rates.

Your health benefits are negotiated between the Union and your employer. If you are unsure what medical plan you have been negotiated into, please refer to the collective bargaining agreement covering your employment or contact the Trust Fund Office at 800-635-3105 for this information.

The national emergency and public health emergency for COVID-19 has ended

Changes in COVID-19-related benefits and administrative deadlines have resulted from the declared end of the national public health emergency that took place on May 11, 2023. Consequently, the plan rules concerning coverage of certain benefits related to COVID-19 changed for services incurred on or after May 12, 2023. In general, the special rules that got put into effect during the emergency period have been terminated and benefits are now covered under the usual cost-sharing provisions of the Fund. This includes COVID-19 vaccines, office visits, emergency room visits, home test kit reimbursement, and co-payment waivers.

In addition to those changes, there are also certain administrative time frames that returned to normal after the end of the National Emergency. These include extension of administrative deadlines of COBRA, HIPAA enrollment periods, submission of benefit claims, and appeals. Details can about these changes can be found on the Trust Fund website at www.aittustfunds.org.

Need Glasses?

Use Vision Service Plan (VSP) Collective bargaining agreements that include vison benefits under the welfare plan are provided exclusively by Vision Service Plan (VSP). The plan has contracted through VSP for many years because of their extensive network of providers.

The vision plan will cover the following services for members:

• Exam every 24 months

• Lenses and Frames every 24 months.

• $25 Exam Copay ($60 Copay for contact lens exam)

• $130 Frame Allowance

• $130 Elective Contact Lens Allowance

You can locate a VSP provider by going to www.vsp.com. VSP also provides an online option for ordering glasses and virtual try-on tools at www.eyeconic.com.

The Member Assistance Program Can Help With Many Life Related Stresses

Even though the pandemic has been declared over, the numbers of cases of people with depression and anxiety along with a host of other mental health issues continue to rise. The Trustees of the Automotive Industries Welfare Fund have partnered with Uprise Health to provide an Employee Assistance Program (EAP) and a Legal/Financial Program (LFP). These resources can help you resolve personal problems in the early stages.

Uprise Health offers a confidential support service and referral program. It is designed to help you and your family with personal issues such as:

• Stress

• Parenting

• Aging

• Grief/Loss

• Anxiety

• Relationships

• Family

• Marriage

• Work Issues

• Alcohol/Drug

• Finances

• Depression

• Adoption

• Estate Planning

• Bankruptcy

• Immigration

• Child Custody

• Real Estate

• Criminal Issues

• Tenant’s Rights

• Divorce

Customer Care Professionals will help you find the right resources and services including counselors, legal representatives, and financial professionals who can provide counseling sessions, coordinate the appropriate treatment, and provide referrals if needed. Office hours are from 6 a.m. to 5 p.m. PST. After-hours calls will be returned the following day. Crisis support is available 24 hours a day, 7 days a week.

The services provided under the EAP and LFP program are 100% confidential and are at no cost to your or your dependents. For more information or to get assistance in making an

appointment, call Uprise Health at 1-888-690- 1349 or visit https://hmc.personaladvantage.com using AUTOMOTIVE as the access code.

Pension plan searching for former participants

The Automotive Industries Pension Plan currently has approximately 2,000 participants who are entitled to receive a pension payment under the plan but have not made application for their money. If you know someone who used to work in the industry during the 1970’s or 1980’s, is over age 65 and is not receiving a pension payment from the Trust Fund, they could be missing out on a monthly payment from the plan.

Have them contact the Trust Fund Office at 800.635.3105 for a review of their work history to see if they are eligible.

COVID-19 national public health emergency to end

The National Public Health Emergency for COVID-19 is set to expire on May 11, 2023. This will impact some of the provisions of the medical plan that were implemented when the pandemic began in March 2020. The Trustees of the Welfare Plan are currently working with our healthcare consultant regarding the expiration of the National Public Health Emergency and will communicate any changes that will be made to the benefits due to the expiration.

Your rights and protections against surprise medical bills

Effective January 1, 2022, the No Surprises Act went into effect that prohibits medical providers from levying “surprise bills” (officially called balance- billing) when you get emergency care or get treated by an out-of-network provider at an in-network hospital or ambulatory surgical center. Getting an unexpected or “surprise” balance bill can happen when you can’t control who is involved in your care—like when you have an emergency or when you schedule a visit at an in-network facility but are unexpectedly treated by an out-of-network provider.

You are protected from balance billing for:

Emergency services: If you have an emergency medical condition and get emergency services from an out-of-network provider or facility, the maximum that the provider or facility may bill you is your plan’s in-network cost-sharing amount (such as copayments and coinsurance). You can’t be balance-billed for these emergency services. This includes services you may get after you’re in stable condition, unless you give written consent and give up your protections not to be balanced billed for these post-stabilization services.

Certain services at an in-network hospital or ambulatory surgical center: When you get services from an in-network hospital or ambulatory surgical center, certain providers there may be out-ofnetwork. In these cases, the most those providers may bill you is your plan’s in-network cost-sharing amount. This applies to emergency medicine, anesthesia, pathology, radiology, laboratory, neonatology, assistant surgeon, hospitalist, or intensivist services. These providers can’t balance-bill you and may not ask you to give up your protections not to be balance-billed.

You’re never required to give up your protections from balance-billing. You also are not required to get care out-of-network. You can choose a provider or facility in your plan’s network.

If you believe you’ve been wrongly billed, you may contact the Automotive Industries Welfare Plan at 800-635-3105, by email at AISupport@hsba.com, or by visiting www.aitrustfunds.org for assistance. Visit www.cms.gov/nosurprises for more information about your rights under federal law.

Update your life insurance beneficiary

You can name anyone to be the beneficiary of your life insurance benefit under the Welfare Plan. Over time, your choice of beneficiary may have changed. The Plan recommends that you review your beneficiaries on a regular basis to make sure you named the correct person to receive the benefit. You can review your beneficiary online through the Trust Funds website at www.aitrustfunds.org. Enrollment forms are also available on the site if you need to update your beneficiary.

Reminder: Pension plan searching for former participants

The Automotive Industries Pension Plan currently has approximately 2,000 participants who are entitled to receive a pension payment under the Plan but have not made application for their money. If you know someone who used to work in the industry during the 1970’s or 1980’s, is over age 65 and is not receiving a pension payment from the Trust Fund, they could be missing out a monthly payment from the Plan. Have them contact the Trust Fund Office at 800-635-3105 for a review of their work history to see if they are eligible.

Automotive Industries Pension Plan: Special Financial Assistance Update

The American Rescue Plan Act of 2021 (ARPA) was signed into law on March 11, 2021. One of the main provisions of ARPA is the “Special Financial Assistance Program for Financially Troubled Multi-Employer Plans,” which will provide funding to troubled pension plans so they can pay their benefit obligations to their participants through the plan year ending in 2051.

The Trustees of the Automotive Industries Pension Plan have been informed by the Pension Benefit Guaranty Corporation (PBGC) that the Plan has been placed into Priority Group 6. This is good news because Priority Group 6 will allow the Plan to submit our application for funding relief in March 2023.

The Trustees are currently working with their actuary and other professionals in preparing the application and the required information for submission in March 2023. The ARPA special financial assistance program is administered by the PBGC and funded by the Treasury’s general revenue. The PBGC will have 120 days from the date of submission to review and approve the application. We will continue to provide you with updates on the progress of the application process as more information becomes available.

Pension Plan 2022 Year-End Tax Documents

The Trust Fund Office will be mailing the Pension Plan 2022 1099-R Tax Forms no later than January 31, 2023, to all retirees receiving monthly pension payments. If you have moved in the last year, please make sure your address is updated with the Trust Fund Office before December 31, 2022.

After January 31, 2023, the 1099-R Tax Forms will also be available on the Trust Fund website at www.aitrustfunds.org and can be downloaded or printed directly from the website. If you don’t already have access to the website, creating an online account is simple and takes minutes to complete. Visit www.aitrustfunds.org for details on how to create an account so that you can review your benefit information.

Your Rights and Protections Against Surprise Medical Bills

Effective January 1, 2022, the “No Surprises Act” went into effect. A surprise medical bill (also called a “balance bill”) occurs when you go to a health care facility, like a hospital or a lab in your plan’s network, and end up with a doctor who is not in your plan’s network and you are charged more than you would have to pay for an in-network doctor. A surprise medical bill can also happen if you are taken to a non-contracted facility in an emergency, and the facility bills you for the remaining balance for the services you got that were not covered by your health plan.

This new law ensures that you are protected from balance/surprise billing for emergency services. If you have an emergency medical condition and get emergency services from an out-of-network provider or facility, the most the provider or facility may bill you is your plan’s in-network cost-sharing amount (such as co-payments and coinsurance). You can’t be balance billed for these emergency services. This includes services you may get after you’re in stable condition unless you give written consent and give up your protections not to be balance billed for these post-stabilization services.

When you get services from an in-network hospital or ambulatory surgical center, certain providers there may be out-of-network. In these cases, the most those providers may bill you is your plan’s in-network cost-sharing amount. This applies to emergency medicine, anesthesia, pathology, radiology, laboratory, neonatology, assistant surgeon, hospitalist, or intensive services. These providers can’t balance bill you and may not ask you to give up your protections not to be balance billed.

You’re never required to give up your protections from balance billing. You also aren’t required to get care out-of-network. You can choose a provider or facility in your plan’s network. If you believe you’ve been wrongly billed, you may contact the Automotive Industries Welfare Plan at (800) 635-3105, by email at AISupport@hsba.com, or by visiting www.aitrustfunds.org for assistance. Visit www.cms.gov/nosurprises for more information about your rights under federal law.

Reminder: Pension Plan Searching for Former Participants

The Automotive Industries Pension Plan currently has approximately 2,000 participants who are entitled to receive a pension payment under the Plan but have not made an application for their money. If you know someone who used to work in the industry during the 1970s or 1980s, is over age 65, and is not receiving a pension payment from the Trust Fund, they could be missing out on a monthly payment from the Plan. Have them contact the Trust Fund Office at 800-635-3105 for a review of their work history to see if they are eligible.

2022 Fund Information

Automotive Industries Pension Plan: Special Financial Assistance Update

The Trustees of the Automotive Industries Pension Plan have been monitoring the Special Financial Assistance Program for Financially Troubled Multiemployer Plans since the American Recovery Plan Act (ARPA) was signed into law on March 11, 2021. The Trustees met in September 2022 with the Plan’s actuary to review the requirements of the program in preparation for making the filing that will enable the government to shore up the union’s pension plan. The date the Plan will be allowed to file its application is expected to be sometime in the first quarter of 2023.

No Increase to Employer Contribution Rates for Welfare Benefits

The employer contribution rates for all Welfare Plan benefits (medical, prescription, dental, orthodontic, vision, life insurance and short-term disability) are reviewed annually by the Trustees and are updated in September of each year. Due to the favorable cost experience of the plan over the past year, the Trustees have determined that there will be no increase in the employer contribution rates for the upcoming rate period. If you have a contract that requires cost sharing of welfare benefits, there will be no change to your cost sharing portion for the rate period of September 2022 – August 2023.

Vision Service Plan (VSP)

Collective bargaining agreements that include vison benefits under the welfare plan are provided exclusively by Vision Service Plan (VSP). The plan has contracted through VSP for many years because of their extensive network of providers. The vision plan will cover the following services for members:

- Exam every 24 months

- Lenses and Frames every 24 months

- $25 Exam Copay ($60 Copay for contact lens exam)

- $130 Frame Allowance

- $130 Elective Contact Lens Allowance

You can locate a VSP provider by going to www. vsp.com. VSP also provides an online option for ordering glasses and virtual try-on tools at www.eyeconic.com.

Employee Assistance Program Services Available Online

HMC HealthWorks is providing all Employee Assistance Program (EAP) services for eligible employees and their dependents. The EAP is a resource to help those enrolled in medical coverage through the fund to address a broad range of personal difficulties that may be causing distress. The EAP offers up to three (3) professional, confidential counseling sessions per employee per incident with a network of professionals including licensed psychologists, social workers, and marriage and family therapists. In addition, legal/financial advice and eldercare/childcare advice is offered. These confidential counseling services are free, with no deductible, copay, or coinsurance. HMC HealthWorks can be reached online at https://hmc.personaladvantage.com and using the Access Code: AUTOMOTIVE. They can also be reached by calling 888.690.1349.

Pension Plan searching for former participants

The Automotive Industries Pension Plan currently has approximately 2,000 participants who are entitled to receive a pension payment under the plan but have not made application for their money. If you know someone who used to work in the industry during the 1970’s or 1980’s, is over age 65 and is not receiving a pension payment from the trust fund, they could be missing out on a monthly payment from the plan. Have them contact the Trust Fund Office at 800-635-3105 for a review of their work history to see if they are eligible.

Reminder: Trust Fund Office Virtual Appointments Available

The Trust Fund Office at Health Services & Benefit Administrators in Dublin, CA continues to offer virtual appointments so members can ask one on one questions with a benefit analyst regarding their medical and pension benefits provided by their collective bargaining agreement. Appointments can be scheduled directly through the Trust Fund webpage at www.aitrustfunds.org . Click on the “Contact Us” icon on the home page and follow the instructions under the “Virtual Appointments” section to set up your appointment.

Assistance with Stress is Available Through Uprise Health

The pandemic and dramatic changes within the workforce have fueled already rising numbers of depression and anxiety along with a host of other mental health issues. The rate of mental health disturbances among adults has increased fourfold since 2019. For younger adults, ages 18 to 24, the increase is even higher.

The Trustees of the Automotive Industries Welfare Fund have partnered with Uprise Health to provide an Employee Assistance Program (EAP) and a Legal/Financial Program (LFP). These resources can help you resolve personal problems in the early stages.

Uprise Health offers a confidential support service and referral program. It is designed to help you and your family with personal issues such as:

Customer Care Professionals will help you find the right resources and services including counseling, legal representation, and financial expertise, helping you to line up counseling sessions, coordinate the appropriate treatment, and offer referrals if needed. Office hours are 6 a.m. to 5 p.m. PST. Afterhours calls will be returned the following day. Crisis support is available 24 hours a day, 7 days a week.

The services provided under the EAP and LFP program are 100% confidential and are at no cost to your or your dependents. For more information or to get assistance in making an appointment, call Uprise Health at 1-888-690-1349 or visit https://hmc.personaladvantage.com using AUTOMOTIVE as the access code.

2021 Annual Funding Notice Mailing

The Trust Fund Office recently mailed out the Automotive Industries Pension Plan’s Annual Funding Notice (AFN) for the 2021 Plan Year. This notice provides information on the Plan’s funding levels and other information on the Pension Plan. The mailing is required by law and is mailed out to all participants on or around the last week of April. The Pension Plan has been certified to be in Critical and Declining Status for many years. The AFN mailed for 2022 showed that the Plan has a funding level of 51.9% as of December 31, 2021.

The Automotive Industry Pension Plan qualifies to receive funding relief from the American Rescue Plan Act (ARPA) under the Special Financial Assistance Program. Under this program, eligible plans will receive funding from the Pension Benefit Guarantee Corp. (PBGC) that will enable the plans to keep paying current benefits to participants through 2051. The Trustees have authorized the actuary to make application to the PBGC when the Plan is allowed to apply for funding relief. The Trustees anticipate that the PBGC will allow them to file their application for the “Special Financial Assistance” sometime in the first quarter of 2023.

Reminder: Pension Plan Searching for Former Participants

The Automotive Industries Pension Plan currently has approximately 2,000 participants who are entitled to receive a pension payment under the Plan but have not made application for their money. If you know someone who used to work in the industry during the 1970s or 1980s, is over age 65, and is not receiving a pension payment from the Trust Fund, they could be missing out on a monthly payment from the Plan. Have them contact the Trust Fund Office at 800-635-3105 for a review of their work history to see if they are eligible.

2021 Fund Information

Employee Assistance Program Services Available Online

HMC HealthWorks is providing all Employee Assistance Program (EAP) services for eligible employees and their dependents.

The EAP is a resource to help those enrolled in medical coverage through the Fund to address a broad range of personal difficulties that may be causing distress. The EAP offers up to three (3) professional, confidential counseling sessions per employee per incident with a network of professionals including licensed psychologists, social workers, and marriage and family therapists. In addition, legal/financial advice and eldercare/childcare advice is offered. These confidential counseling services are free, with no deductible, copay, or coinsurance.

HMC HealthWorks can be reached online at https://hmc.personaladvantage.com and using the Access Code: AUTOMOTIVE. They can also be reached by calling 888-690-1349.

No Increase to Employer Contribution Rates for Welfare Benefits

The employer contribution rates for all Welfare Plan benefits (medical, prescription, dental, orthodontic, vision, life insurance, and short-term disability) are reviewed annually by the Trustees and are updated in September of each year.

Due to the favorable cost experience of the plan over the past year, the Trustees have determined that there will be no increase in the employer contribution rates for the upcoming rate period. If you have a contract that requires cost sharing of welfare benefits, there will be no change to your cost-sharing portion for the rate period of September 2021–August 2022.

Orthodontic Benefit to be Increased to $3,000 Effective January 1, 2022

Effective January 1, 2022, the benefit will be increased from the current benefit of $2,500 per lifetime to $3,000 per lifetime. The Orthodontic benefit is self-funded 100% by the Welfare Plan and administered through the Trust Fund Office. The benefit covers all related orthodontic services such as x-rays, photographs, tracing, study models, and banding—for children and adults.

Subsidized COBRA Available through September 30, 2021

The American Rescue Plan Act (ARPA) provides an employee who lost their job due to a COVID-related event a 100% subsidy of their COBRA premium. The COBRA election forms sent from the Trust Fund Office have been updated to include all the required forms to apply for this subsidy. A completed form must be submitted with your COBRA election in order to qualify for the subsidy.

If you have questions about the subsidy and if you qualify, please contact the Trust Fund Office at 800-635-3105.

Pension Plan Searching for Former Participants

The Automotive Industries Pension Plan currently has approximately 2,000 participants who are entitled to receive a pension payment under the Plan but have not made application for their money. If you know someone who used to work in the industry during the 1970s or 1980s, is over age 65 and is not receiving a pension payment from the Trust Fund, they could be missing out on a monthly payment from the Plan. Have them contact the Trust Fund Office at 800-635-3105 for a review of their work history to see if they are eligible.

Reminder: Trust Fund Office Still Closed for Walk-in Appointments

The Trust Fund Offices have been closed to walk-in appointments due to the COVID-19 pandemic. To service members effectively, the Trust Fund Office has made Zoom appointments available so you can talk directly with a staff member about your specific benefit questions. Please visit the Trust Fund webpage at www.aitrustfunds.org and click on the “Contact Us” icon to set up your appointment.

Extended Election Period and Subsidized COBRA

The recently enacted American Rescue Plan Act of 2021 (ARPA) will allow for a 100% subsidy of COBRA continuation premiums effective April 1, 2021 through September 30, 2021. The subsidy applies to “assistance eligible individuals” who were eligible for continuation coverage during some or all of the subsidy period by having lost coverage because of a reduction of hours or involuntary termination of employment due to the COVID-19 pandemic. All members who lost coverage starting April 1, 2021 and forward will qualify for this subsidy.

The ARPA also requires the Welfare Plan to extend the COBRA election period to any COBRA-eligible individual that had a qualifying event effective November 1, 2019 to April 1, 2021. Qualifying members who lost coverage effective November 1, 2019 and did not elect COBRA continuation coverage will receive a notice from the Trust Fund Office that they qualify to elect COBRA effective April 1, 2021 and forward. If you feel you qualify for this special COBRA enrollment period or have any questions, please contact the Trust Fund Office at (800) 635-3105.

Blue Cross Self-Funded Plan Participants – Get an Annual Physical to Lower Your Deductible

If you are currently in the higher deductible level for your medical coverage under the Blue Cross Self-Funded plan, you can lower your deductible for the remainder of the calendar year 2021 by having an annual physical exam by your primary care physician. You must complete and submit an Exam Certification Form to the Trust Fund office. You can find the form under the Plan Documents & Forms section of the Trust Fund website at www.aitrustfunds.org.

The Trust Fund Office now offers Zoom appointments

The Trust Fund Office has been closed for walk-in appointments since March 17, 2020 due to the COVID-19 pandemic. Effective June 1, 2021, you will be able to make an appointment with the Trust Fund office through a Zoom video conference call. Appointments can be scheduled through the www. aitrustfund.org website, with appointments available M o n d a y – F r i d a y from 8:30 a.m.-3:00 p.m. You will receive a private one-onone appointment with a department staff member to discuss all Trust Fund business including medical coverage and eligibility, pension, COBRA, and disability.

2020 Annual Pension Statements

The Automotive Industries Pension Plan will be sending their annual statements to all participants that worked for a qualifying employer in the calendar year 2020. If you did not work in the calendar year 2020, you can review your prior year contributions and vesting status by visiting the Trust Fund website at www.aitrustfunds.org.

Pension plan funding relief under the American Rescue Plan Act of 2021

As discussed on page 1, the American Rescue Plan Act provides for funding relief to Pension Plans in Critical and Declining Status, such as the Automotive Industries Pension Plan. Please be aware that the Trust Fund Office has no additional information about this funding relief or the process of applying for the funding relief, other than what is in the American Rescue Plan Act.

The Trust Fund Office will have no other information on this provision of the American Rescue Plan until the rules and regulations are sent out by the federal government in mid-July 2021.

New Employee Assistance Program Provider

The Board of Trustees has replaced Managed Health Network (MHN) with HMC HealthWorks as the new Employee Assistance Program (EAP) vendor for all employees. The new provider will begin offering services on or after April 1, 2021.

The EAP is a resource to help those enrolled in medical coverage through the Fund to address a broad range of personal difficulties that may be causing distress. The EAP offers up to three (3) professional, confidential counseling sessions per employee per incident, with a network of professionals including licensed psychologists, social workers, and marriage and family therapists. In addition, they can offer advice around legal/financial issues, as well as eldercare/childcare. These confidential counseling services are free, with no deductible, copay or coinsurance.

HMC HealthWorks will be sending additional information directly to participants on the services that can be provided, as well as a dedicated member portal that will have additional resources.

2020 Year End Tax Forms

Below is a listing of the 2020 Year-End tax forms that were mailed out by the Trust Fund Office to qualified participants as of January 31, 2021, as required by law.

- Automotive Industries Pension Plan – 1099-R

This form is distributed to all plan participants who are currently in pay status or who retired in the calendar year 2020 under the Automotive Industries Pension Plan. In addition to mailing these forms, all 1099-R Forms have been uploaded to every retiree’s individual account on the benefit website and can be printed directly from the site. Visit www. aitrustfunds.org for details on how to obtain a copy electronically. (Prior year forms available through the website will be following IRS guidance and only provide truncated taxpayer identification numbers. However, the complete identification number will be provided to the IRS. This action is being taken to reduce the risk of identity theft.)

- Individual Account Retirement Pension Plan – 1099-R

This form is distributed to all participants who took a distribution from their Individual Account Retirement Pension Plan in the calendar year 2020.

- Automotive Industries Welfare Plan (Short Term Disability) – Form W-2

This form is distributed to all plan participants that received Short Term Disability payments from the Welfare Plan in the calendar year 2020. This form will not include any additional payments

- Automotive Industries Welfare Plan – Form 1095-B

This form is distributed to all plan participants that participated and received medical and prescription drug coverage under the plan in the calendar year 2020. If you were a member of the self-funded medical plan, you will receive this form from the Trust Fund Office. If you were a member of Kaiser, this form will be mailed directly from Kaiser.

Please contact the Trust Fund Office at 800-635- 3105 should you need any assistance receiving a duplicate copy of any of the above forms. Consult your tax professional if you have questions about what impact any of the above forms will have on your tax obligation for the calendar year 2020.

COVID-19 National Emergency Extended for Testing and Treatment Services

The declared National Emergency due to the COVID-19 pandemic has been extended into April 2021 by the Department of Health and Human Services. This means that the coverage provided by the Plan for testing and medical treatment relating to COVID-19 have also been extended.

Services for COVID-19 testing provided at In-Network and Out-of-Network providers and facilities will continue to be covered at 100% of the allowed charges with no cost sharing to you or your eligible dependents.

Services for COVID-19 treatment provided at In-Network providers and facilities will continue to be covered at 100% of the allowed charges with no cost sharing to you or your eligible dependents.

Resources for the Blue Cross Plan and the Kaiser Medical Plan can be found on the Trust Fund website at www.aitrustfunds.org.

Visit the Centers for Disease Control and Prevention (CDC) for the latest information regarding the COVID-19 pandemic: cdc.gov/coronavirus/ 2019-ncov or the State of California’s COVID-19 webpage: covid19.ca.gov

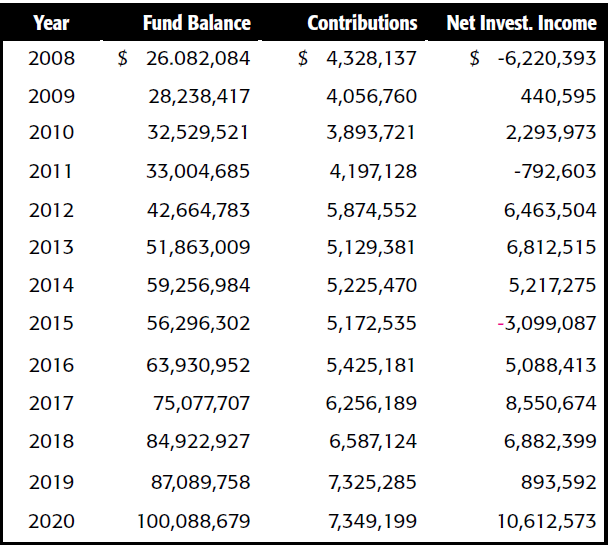

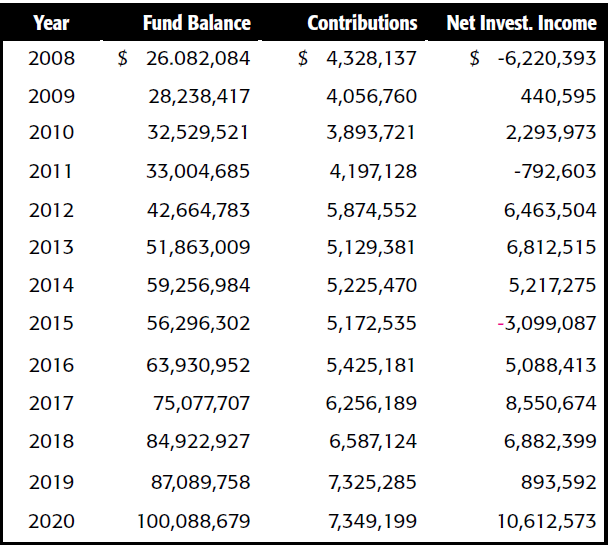

Good news chart for the 401K plan

Economies go up and down and that has a major impact on Fund returns. Long after a disastrous 2008 when investment income was negative $6 million, the fund came into 2021 with well over $10 million in growth, and the growth rate for the year was 13%.

Employer contributions are also significantly higher, going from about $4.3 million to over $7.3 million.

Here’s a quick review of the Fund’s history, based on audited financials (except for 2020, which has not yet been audited).

District celebrates 25th Anniversary of 401K Plan

Blue Cross Self-Funded Medical Plan Participants

Annual Wellness Program – Health Dynamics Testing Requirement Suspended for 2021 The Board of Trustees has made the decision to suspend the wellness program Health Dynamics testing requirement for the Calendar Year 2021 (January 1 – December 31).

If you are on the lower deductible plan effective December 31, 2020, there is no action to be taken. You will remain on the lower deductible plan for the Calendar Year 2021.

If you are on the higher deductible plan effective December 31, 2020, or became a new participant anytime in the calendar year 2020, you will have the opportunity to move your coverage to the lower deductible plan in the Calendar Year 2021 by having a routine physical exam performed. Only the member needs to have the routine exam, there is no requirement for the dependent spouse to receive an exam.

An Exam Certification Form will be mailed from the Trust Fund office toward the end of November and is also available on the Trust Fund Website www.aitrustfunds.org. Please note that due to the National Emergency due to the COVID-19 pandemic, the Trust Fund office will accept electronic signatures in lieu of physically signed forms. Forms received in the Trust Fund office on or before February 28, 2021, will have deductibles reduced for claims incurred on or after January 1, 2021. Forms received on or after March 1, 2021, will have deductibles reduced for claims incurred starting the first of the month the form was received by the Trust Fund Office.

Scheduling a Surgery? Remember to Verify Benefit Coverages and that All Providers are In-Network

Having surgery is a stressful event and fortunately, the Plan covers a wide range of surgery benefits for our members. However, it is important to check that all your providers, not just your surgeon, are in-network providers under the Plan. An in-network surgeon may have privileges at an out-of-network hospital or surgery center, which are covered at a much lower level than in-network providers. You should not assume that the doctor is automatically selecting an in-network facility. You will save yourself money and give yourself peace of mind by taking the time to confirm that each provider and facility is in-network.

You can access the Blue Cross Provider Network online at www.anthem.com or you can call directly at 800-810-2583.

HRA Debit Card Confirmation Letters – Why is the Trust Fund mailing these?

If you utilize an HRA Debit Card with your medical benefits, you probably have received a letter from the Trust Fund Office asking for additional information on services that were charged to the card. The question most asked about these letters is, “Do I really have to send the information requested to the Trust Fund office?”

The letter is known as a “substantiation letter” and is being sent by the Trust Fund office because the IRS requires the Welfare Plan to verify if all charges and purchases made using the HRA card were for an eligible medical expense (as defined by the IRS). Substantiation letters are not generated for all card transactions. They are usually generated when the amount that is paid through the card does not match the Plan information. Information that is being confirmed is:

• Service Date or Purchase Date

• Description of Service/Item Purchase

• Name of Provider/Merchant

• Claim Amount

As a participant in the Plan, you are required to complete the substantiation letter and provide documents that will confirm the information required by the IRS. In most cases, the Explanation of Benefits (EOB) from the medical provider or HMO will be enough information to fulfill the substantiation letter requirements. If you have any questions about the letters or what documentation needs to be provided, please call the Trust Office.

2020 Retiree Tax Information

The Trust Fund Office will be mailing the Pension Plan 2020 1099-R Tax Forms no later than January 31, 2021, to all retirees receiving monthly pension payments. If you have moved in the last year, please make sure your address is updated with the Trust Fund Office before December 31, 2020.

After January 31, 2021, the 1099-R Tax Forms will also be available on the Trust Fund website at

www.aitrustfunds.org and can be downloaded or printed directly from the website. If you don’t already have access to the website, creating an online account is simple and takes minutes to complete. Visit www.aitrustfunds.org for details on how to create an account so that you can review your benefit information.

Reminder: Keep Your Personal Information Updated at the Trust Fund Office

Always remember to update your personal information as soon as possible with the Trust Fund Office. Life events such as marriage, divorce, or the birth of a child are time-sensitive and could cause problems with your benefits if you don’t take the required action. All forms are located at the Trust Fund Website at www.aitrustfunds.org. Call the Trust Fund Office at 800-635-3105 if you have any questions or need help completing the forms.

2020 Fund Information

Welfare Plan Actions during COVID-19 (COVID-19) Pandemic

It has been six months since the COVID-19 (COVID-19) changed how we go about our daily lives. During this time, the Board of Trustees of the Automotive Industries Welfare and Pension Plans have continued to monitor the impact of the pandemic and have continued to provide relief for the members and dependents who rely on the Plans for benefits.

Blue Cross

The Blue Cross Direct Pay Plan will continue to have all testing for diagnosis of COVID-19 covered at 100% (both In-Network and Out-of-Network) and In-Network COVID-19 treatment covered at 100% until the National Emergency is declared over.

The Trustees have also extended the Co-payment waiver whenever Blue Cross LiveHealth Online telehealth services are used. The Co-payment is waived for all treatment, not just relating to COVID-19.

Kaiser

For participants who have elected coverage in the Kaiser medical plan, please visit https://healthy.kaiserpermanente.org/health-wellness/coronavirus-information for information on how Kaiser is assisting participants during the COVID-19 pandemic.

Important Resources

• Resources for the Blue Cross Plan and the Kaiser Medical Plan can be found on the Trust Fund website at www.aitrustfunds.org.

• Visit the Center to Disease Control and Prevention (CDC) for the latest information regarding the COVID-19 pandemic https://www.cdc.gov/COVID-19/2019-ncov/index.html or the State of California webpage dedicated to COVID-19 at https://covid19.ca.gov/

Individual Account Retirement Plan–COVID-19 Distributions

For all participants in the Automotive Industries Individual Account Retirement Plan, as of April 1, 2020, if you have been diagnosed with COVID-19 by a test approved by the Centers for Disease Control and Prevention (CDC), have a spouse or dependent who is diagnosed with COVID-19 by such test, or if you have experienced adverse financial consequences as a result of COVID-19, you may be able to take a distribution not to exceed the lesser of (i) 50% of your Individual Account balance, or (ii) $100,000. This temporary COVID-19 Distribution is available from April 1, 2020 to December 31, 2020, in accordance with the CARES Act.

To apply you will need to certify in writing that you meet one of the following criteria:

• You are diagnosed with COVID-19 by a test approved by the CDC;

• Your spouse or dependent is diagnosed with COVID-19 by such a test; or

• You experience adverse financial consequences as a result of COVID-19 because you, your spouse, or a member of your household:

• was quarantined, furloughed, laid off;

• had a reduction in work hours, or closure or reduced hours of business;

• was unable to work due to lack of childcare;

• had a reduction in pay or self-employment income; or

• other factors as determined by the Secretary of the Treasury.

If you believe that you may qualify to take this distribution, you should contact the Trust Fund Office for an application at 800-635-3105.

Reminder: All Your Benefit Information Is Online

All your benefit information is available on the Trust Fund website: www.aitrustfunds.org All relevant information regarding plan benefits is available at the website page.

If you are a participant in any of the related plans: Welfare, Pension, Individual Account Pension Plan or Michael J. Day, the Plan has created a personal account page containing your information that can be accessed once a “User Account” is created. If eligible, there is a downloadable application for benefits available on the website.

Your medical benefits during the Coronavirus (COVID-19)

The Coronavirus (COVID-19) and the global pandemic it created has impacted the participants in the Automotive Industries (AI) benefit plans in numerous ways. The Board of Trustees has taken steps to help participants under the AI Welfare Plan.

Blue Cross Direct Pay Plan

For Blue Cross Direct Pay Plan participants, effective for services received on or after March 18, 2020 and through the end of the emergency period in which the federal government has announced a National Emergency, the Fund will cover:

COVID-19 Testing – Covered at 100%

Diagnostic tests for COVID-19 from either an In-Network or Out-of-Network provider at 100% of the allowed charge, with no cost sharing to you or your dependents.

COVID-19 Treatment – Covered at 100% (In-Network Only)

Treatment of COVID-19 received from an In-Network provider at 100% of the allowed charge, with no cost sharing to you. This means that if a member receives treatment under a COVID-19 admission or diagnosis code from an In-Network provider during this time, the Plan will waive cost sharing.

In order to receive benefits at no cost sharing, you will have to receive treatment under a confirmed positive diagnosis of COVID-19, or have an inpatient admission for COVID-19, and your provider will need to use the correct codes for the diagnosis/treatment.

OptumRx – Prescription Drug Refills

OptumRx is waiving any refill-too-soon edits. This allows eligible OptumRx members to obtain early refills of their prescription medications if they have refills remaining on file at a participating retail or mail-order.

Blue Cross LiveHealth Online

Copayment Waiver for all Treatment.

Anthem Blue Cross LiveHealth Online

Anthem Blue Cross LiveHealth Online services will be provided with no cost-sharing for all treatment received. Please remember, LiveHealth Online is the Plan’s only provider for telehealth services where all cost sharing will be waived, except as otherwise provided for COVID-19 related tests and treatment, described above. Charges for any/all phone or online calls with another provider (In-Network or Out-of-Network), or any other services received where you are not personally examined by the provider will be covered at normal plan benefits (deductible, coinsurance).

Full information on the above benefit changes can be found on the Trust Fund website at www.aitrustfunds.org.

Kaiser

For participants who have elected coverage in the Kaiser medical plan, please visit https://healthy.kaiserpermanente.org/health-wellness/coronavirus-information for information on how Kaiser is assisting participants during the COVID-19 pandemic.

Visit the Centers for Disease Control and Prevention (CDC) for the latest information regarding the COVID-19 Pandemic: https://www.cdc.gov/coronavirus/2019-ncov/index.html

or the State of California webpage dedicated to COVID-19 at https://covid19.ca.gov/

Reminder: Looking for Former Pension Plan Participants

The Automotive Industries Pension Plan has approximately 2,000 participants over the age of 65 who are entitled to begin receiving their monthly benefit payment under the Plan but have not started the application process. If you believe that you or someone you know may be entitled to benefits under the Pension Plan, please contact the Trust Fund Office at 800-635-3105 and ask to speak with the Pension Department.

You may also view your pension benefit information on the Automotive Industries Pension Plan benefit website at www.aitrustfunds.org. The Plan has created a personal account page containing your pension information which can be accessed once a “User Account” is created. If eligible, there is a downloadable application for benefits available on the website.

About your 401K

If you looked at your 401K quarterly report for the quarter ending on March 31, you likely felt a shock at how quickly your retirement savings

could disappear. “The stock market cratered in March, decreasing by 14% in the first quarter,” says Area Director Don Crosatto. “However, we’ve seen a tremendous uptick in the last two months. As of June 4, the Growth Fund of America was down 15% in first quarter, but is now up 4% year-to-date. While other funds have not gone down or up quite so dramatically, as of June 4, most were down no more than 6%. Most of our members are invested in Target Date funds, which, at that time, were down at most by 2.4%, and many are even. Hopefully, when you look at your Second Quarter statement, you’ll feel some relief.”

Thank you for your patience

By Don Crosatto, Area Director

On a personal note, I’d like thank the members for their patience during this crisis.

When the pandemic suddenly hit and the Bay Area counties were the first in the state ordered to shut down and shelter in place, our Alameda County-based Trust Fund was forced to send its workforce packing. They closed their offices and put everybody to work on computers at home, in many cases that entailed buying new computers and needing to be very conscious of privacy and security issues. The process was a scramble, but it ultimately went very smoothly, and we’ve gotten no calls of complaint!

The vast majority of members that we’ve interacted with over the last few months have been patient, understanding the fact that it may take longer to get back to them, or we have to do business differently than normal. They’ve kept their good humor, which has made everyone’s life easier in a difficult time.