Fund Info

Vision Benefit Increased for Health Plan Participants – Eye Exams Now Available Every 12 Months

The Board of Trustees is pleased to announce the Fund has approved an improvement to the vision benefit, effective for services on or after July 1, 2025.

At this time, your Vision Plan provides for an eye exam every 24 months. Effective July 1, 2025, the Plan will allow for an eye exam every 12 months for you and your eligible dependents. You will see that this frequency change only applies to the vision exam. All other benefits are available once every 24 months.

Full details about this change are available at www.aitrustfunds.org.

Trustees Add New Vendor to Health Plan – Cancer Navigator

Hearing the word “cancer” is a life-changing experience for everyone. Over this past year, the Board of Trustees has been reviewing ways to help our participants navigate the healthcare system if a cancer diagnosis is received. The trustees have contracted with CancerNavigator to assist our members with navigating the health care system if you receive a cancer diagnosis.

You can utilize the services of CancerNavigator at any time during your cancer treatment process. The CancerNavigator team will provide you with unlimited support including education and helping you to connect with doctors specializing in cancer diagnostics in order to receive prompt and accurate diagnoses and treatment. For example, if you would like to have a second opinion, CancerNavigator will schedule and facilitate the appointment.

CancerNavigator services are currently only offered to participants enrolled in the Self-Funded Anthem Blue Cross PPO Plans. Kaiser participants are not eligible to participate in these services at this time. Visit www.cancernavigator.com/aitrustfunds to learn more.

Annual “Reminder to Retire” Mailed by Pension Plan

The Trust Fund Office has mailed out the Pension Plan’s annual “reminder to retire” notices to all participants in the Automotive Industries Pension Plan that are eligible to receive a benefit payment but have not made application to do so. If you have received this notice and have any questions about your benefit or how to apply, please contact the pension department at 800-635-3105 and one of our analysts will walk you through the process.

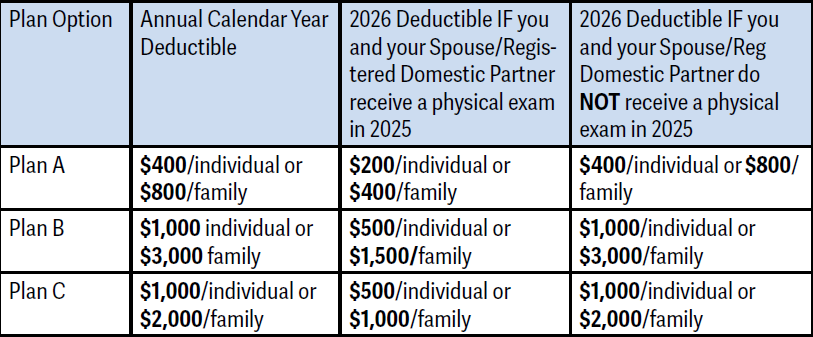

Annual Physical Required to Lower Deductible in 2025 Under Blue Cross Self-Funded Plan Options

In 2023, the Board of Trustees instituted an annual physical exam requirement for those on the self-funded medical plans offered by the Automotive Industries Welfare Plan in order to receive a lower calendar-year deductible. The deductible amounts are now in place for the 2025 Calendar Year, but participants and their spouse or domestic partner (if applicable), who get an annual physical exam anytime in 2025 will be moved to the lower deductible level in the 2026 calendar year along with all dependent children.

The physical exam can be taken any time before the end of the 2025 calendar year (December 31) and requires the plan’s certification form to be sent to the Trust Fund Office.

Physical exam certification forms are available to download at the Trust Fund website at www. aitrustfunds.org. A separate form must be submitted for you and your spouse or domestic partner (if applicable) to reduce your deductible for the 2026 calendar year.

If you have questions about what current deductible level you are in, please contact the Trust Fund Office at 800-635-3105 or by email at AISupport@ hsba.com.

Pension Plan Searching for Former Participants

About 2,000 participants are entitled to receive a pension payment under the Automotive Industries Pension Plan but have not made application for their money. If you know someone who used to work in the industry during the 1970s or 1980s, is over age 65, and is not receiving a pension payment from the Trust Fund, they could be missing out on a monthly payment from the Plan. Have them contact the Trust Fund Office at 800-635-3105 for a review of their work history to see if they are eligible.

Reminder: Update Your Address with the Trust Fund Office

You should update your address with the Trust Fund Office within 30 days of moving to your new residence.

You can submit your address change directly through the Trust Fund website at www.aitrustfunds.org by logging onto your personal account and completing the online form.

Health and Retirement Benefits

If you are looking for information about your health and pension benefits, please contact:

Automotive Industries Trusts Funds

Health Services & Benefit Administrators

4160 Dublin Boulevard, Suite 100

Dublin, CA 94568-7756

Phone (800) 835-3105

Email: AISupport@hsba.com

Website: www.aitrustfunds.org

Charles W. Besocke,

Fund Manager

IAM National Pension Fund

1300 Connecticut Avenue, NW, Suite 300

Washington, DC 20036-1711

Phone: 1-800-424-9608

Email: iamcontact@iamnpf.org

Website: www.iamnpf.org

IAM introduces new Group Medicare Plan

The IAM has worked for months to negotiate a new Group Medicare plan for Medicare-eligible retirees, spouses, surviving spouses and Medicare-eligible dependents.

In October, the IAM announced a new partnership with Employee Benefit Systems and TLC Insurance Group. This plan can help serve the Medicare needs for our Medicare-eligible retirees, their spouses, and surviving spouses. This new best-in-class IAM Group Medicare Advantage plan, offered through Humana, is rich in benefits.

Visit iam4.me/iamhumana for more information.

Here are some of the benefits that IAM retirees are so excited about:

• Available in all 50 states, plus Puerto Rico and the District of Columbia;

• National Passive Group Medicare PPO Plan that allows members to use the doctor and hospital of their choice nationally;

• In-network and out-of-network benefits are identical;

• Robust Prescription Group Plan included;

• Low out of pocket maximum;

• No deductibles on the IAMAW Group plan;

• Low copays! Primary Care Physician – $0 copay Specialist – $30 copay

By now, you should have received an announcement letter, followed by a group enrollment packet with details on the new group plan. If you have questions, feel free to call the Humana Enrollment Department toll free at 1-800-833-2411 for questions and enrollment assistance.

Retiree participation is not mandatory. Enrollment into the plan is by self-choice. The IAM recommends that all retirees compare the benefits of this new IAM Group Medicare plan with their current coverage prior to making any decision on their 2021 Medicare healthcare options. Visit iam4.me/iamhumana for more information.

Fund Info Archive

You’ll always have access to all Fund Info articles.